Business Calculus

Business Calculus Use of integral

1.5-year total sales

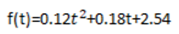

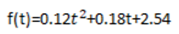

If company A's sales for the next five years are projected as follows, what is the total sales for the next five years?(Unit: billion yen)

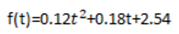

Definite integral as follows

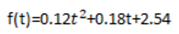

=

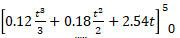

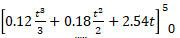

= =19.95 (billion yen) is correct.

=19.95 (billion yen) is correct.

Integral allows for more precise calculation than rectangle.

2. Break-even analysis

A drastic change in the business environment is expected in certain management decisions. In that case, you have to make decisions that take uncertainty into account. Rather than considering the "points" of the premise that the business environment will not change, considering the "space/area" will enable you to make correct decisions that are resilient to changes in the business environment. Use Break Even Space (BES) analysis instead of Break Even Point(BEP) . Compute the profit space/area in definite integral.

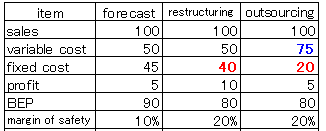

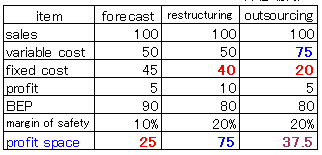

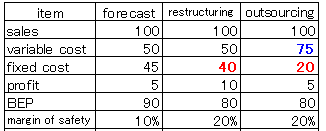

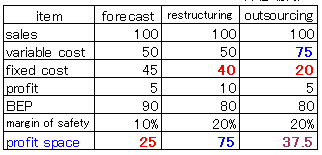

Company B's forecast for the next fiscal year is as follows, and the profit is 500 million yen, and the margin of safety is low at 10%. There is a high possibility that the next term's sales will fall within the range of 9 billion to 10 billion yen due to drastic changes in exchange rates and crude oil prices. Taking these into consideration, the Board of Directors of Company B decided that the margin of safety should be increased to 20%. As a methodology, the "restructuring plan" to reduce fixed costs by 500 million yen and the "outsourcing plan" to change fixed costs to variable costs by 2.5 billion yen were considered.

(Unit: Okuyen,100m yen)

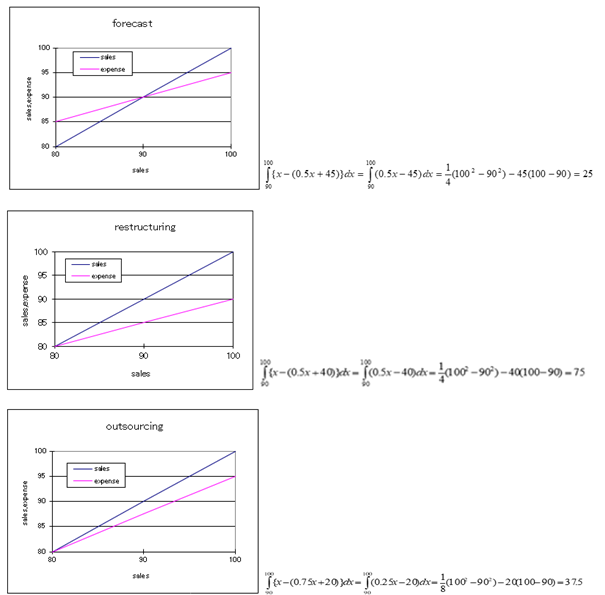

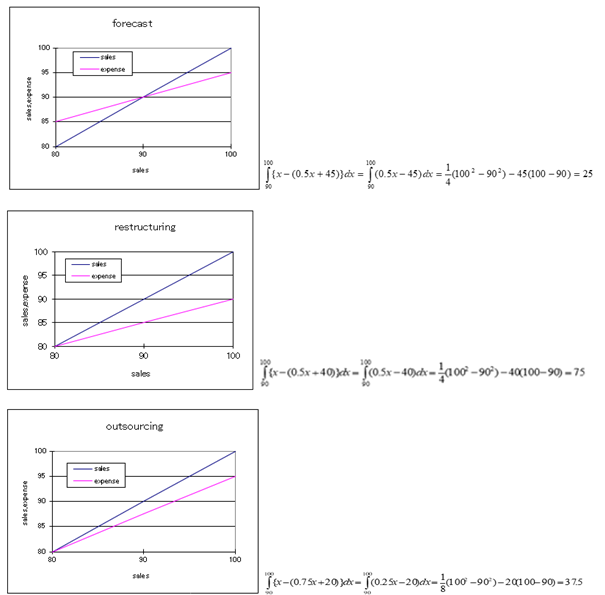

Consider the impact of next year's forecasts, restructuring, and outsourcing earnings plans.

Calculating the profit area with sales of 9 to 10 billion yen in 3 cases.

Thinking from "BEP (Break Even Point)”to BES (Break Even Space)"

The profit area for the change in sales (9 billion to 10 billion yen) is in the order of restructuring -> outsourcing -> forecast for the next fiscal year.

In terms of profit planning, it is desirable to implement restructuring measures that maximize the profit area even if it is difficult from a management point of view.

cf.

In these three cases, sales and expenses are represented by straight lines, so profit area can be calculated as follows without using definite integral.

Case 1:Triangle (100-95)X10/2=25

Case 2:Trapezoid (10+5)X10/2=75

Case 3:Trapezoid (5+2.5)x10/2=37.5

3. Selection of investment proposal

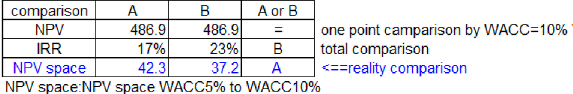

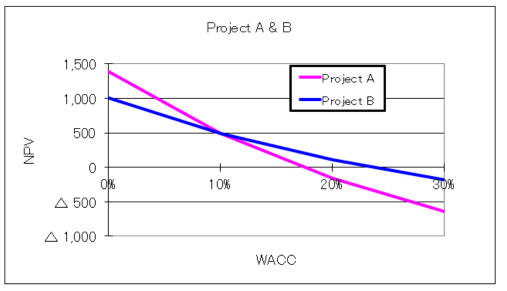

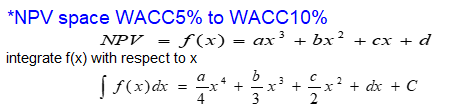

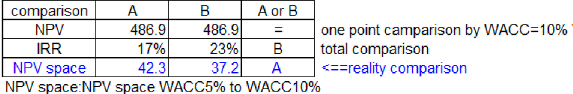

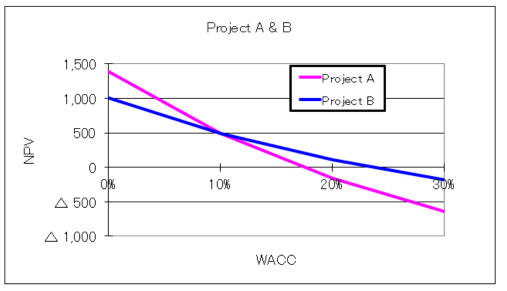

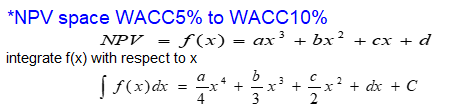

The current standard method of financial management is to use NPV(Net Present Value) to select investment proposals. Similar to the break-even analysis above, it is safer to make decisions in terms of are as rather than points in high-uncertainty investment deals. You can use definite integrals to calculate the area of NPV and make economically rational decisions.

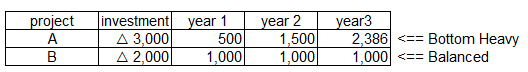

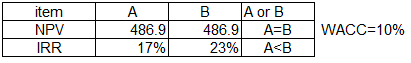

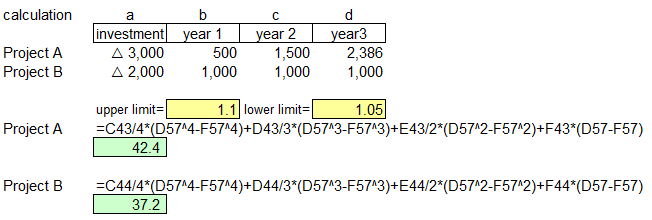

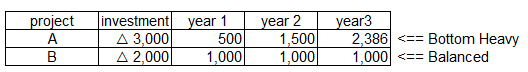

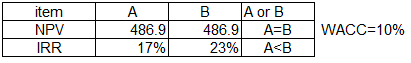

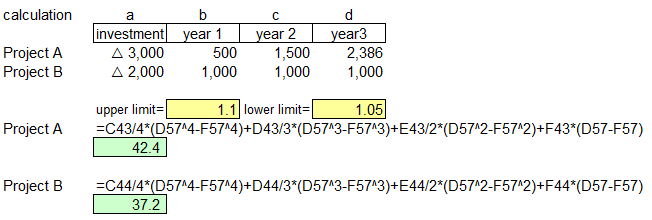

Company C proposed two projects, A and B, to the board of directors as investment projects.

NPR is the same, the IRR(Internal Rate of Return) of project B is better, and the investment amount of B is smaller, so project B was adopted. Is it a decision based on correct economic rationality?

Project A should be adopted by comparing the actual range of WACC(Weighted Average Cost of Capital).

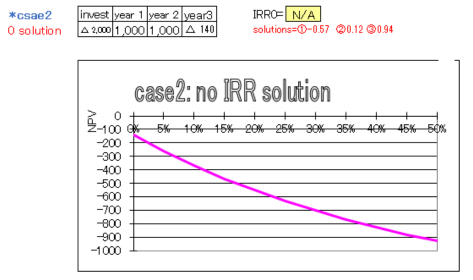

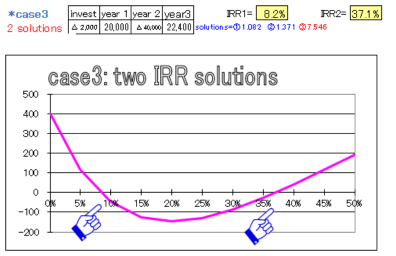

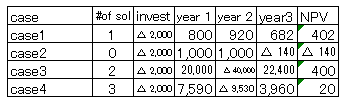

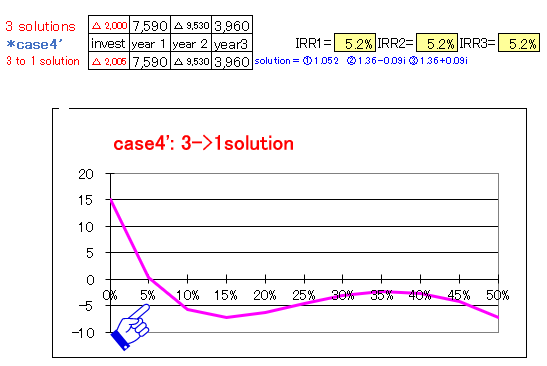

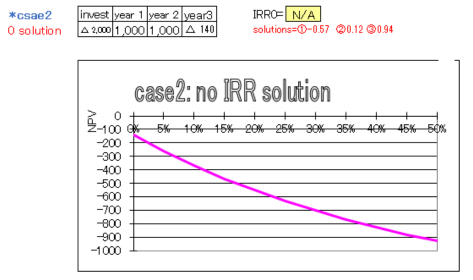

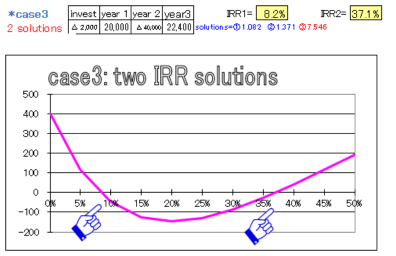

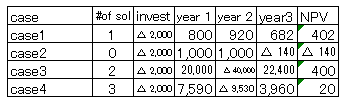

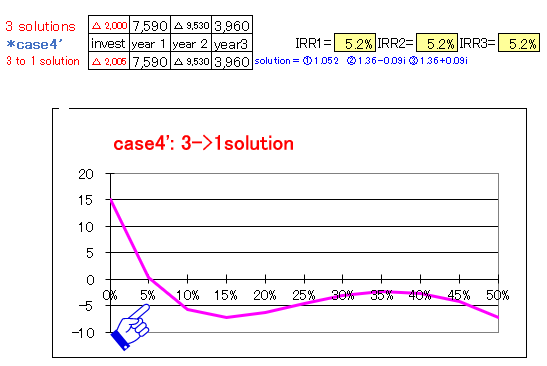

4. Multiple IRR solutions and their correspondence

One of the pain points in current investment decision-making is that multiple IRRs are calculated. This has been known for some time, but in practice it is extremely rare and could be ignored. Recently, however, it is not uncommon for an investment project in a certain country to have negative cash in the final year (accounting year) and multiple IRRs. We will solve this problem with business calculus.

1) Why do multiple IRR solutions occur?

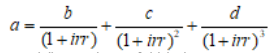

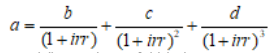

*The unique profit rate for each project, taking into consideration up to the third period

e.g. initial investment amount: a, period 1: b, period 2: c, period 3: d.

*at which the NPV becomes zero.

The investment up to the third period can be represented by a 3dimensional equation, given by 1 + IRR = X.

<-- 3dimensional equation for x.

<-- 3dimensional equation for x.

The equation can have 1 to 3 real solutions.

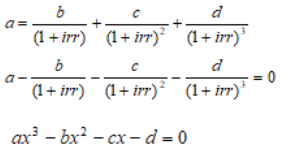

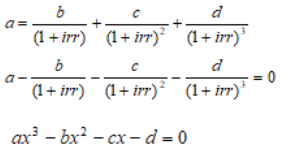

* If the IRR solution is not negative

There can be 0 to 3 real solutions, including possible solutions with imaginary components. This is because the solutions may include 1, 2 or 3 real roots, or 1 real root and a pair of complex conjugate roots.

*If there are no negative cashflows in the equation

There can be 0 or 1 real solutions for IRR, depending on whether the cashflows have the same sign or not. If all cash flows are positive, there will be only one real solution for the IRR. If there are both positive and negative cash flows, there may be 0 or 1 real solutions for the IRR, depending on the magnitude and timing of the cash flows."

2) Actual profile

3) Practical countermeasures

(1)Create an NPV profile -> Reconsider your company's WACC and NPV.

(2)In general, many projects with multiple IRR solutions have low NPV -> Reject the projects

(3) Initial investment and readjustment of inflow in each period→Avoid multiple solutions

A quick note on business calculus: Calculation of pi by definite integral

1.5-year total sales

If company A's sales for the next five years are projected as follows, what is the total sales for the next five years?(Unit: billion yen)

Definite integral as follows

=

= =19.95 (billion yen) is correct.

=19.95 (billion yen) is correct. Integral allows for more precise calculation than rectangle.

2. Break-even analysis

A drastic change in the business environment is expected in certain management decisions. In that case, you have to make decisions that take uncertainty into account. Rather than considering the "points" of the premise that the business environment will not change, considering the "space/area" will enable you to make correct decisions that are resilient to changes in the business environment. Use Break Even Space (BES) analysis instead of Break Even Point(BEP) . Compute the profit space/area in definite integral.

Company B's forecast for the next fiscal year is as follows, and the profit is 500 million yen, and the margin of safety is low at 10%. There is a high possibility that the next term's sales will fall within the range of 9 billion to 10 billion yen due to drastic changes in exchange rates and crude oil prices. Taking these into consideration, the Board of Directors of Company B decided that the margin of safety should be increased to 20%. As a methodology, the "restructuring plan" to reduce fixed costs by 500 million yen and the "outsourcing plan" to change fixed costs to variable costs by 2.5 billion yen were considered.

(Unit: Okuyen,100m yen)

Consider the impact of next year's forecasts, restructuring, and outsourcing earnings plans.

Calculating the profit area with sales of 9 to 10 billion yen in 3 cases.

Thinking from "BEP (Break Even Point)”to BES (Break Even Space)"

The profit area for the change in sales (9 billion to 10 billion yen) is in the order of restructuring -> outsourcing -> forecast for the next fiscal year.

In terms of profit planning, it is desirable to implement restructuring measures that maximize the profit area even if it is difficult from a management point of view.

cf.

In these three cases, sales and expenses are represented by straight lines, so profit area can be calculated as follows without using definite integral.

Case 1:Triangle (100-95)X10/2=25

Case 2:Trapezoid (10+5)X10/2=75

Case 3:Trapezoid (5+2.5)x10/2=37.5

3. Selection of investment proposal

The current standard method of financial management is to use NPV(Net Present Value) to select investment proposals. Similar to the break-even analysis above, it is safer to make decisions in terms of are as rather than points in high-uncertainty investment deals. You can use definite integrals to calculate the area of NPV and make economically rational decisions.

Company C proposed two projects, A and B, to the board of directors as investment projects.

NPR is the same, the IRR(Internal Rate of Return) of project B is better, and the investment amount of B is smaller, so project B was adopted. Is it a decision based on correct economic rationality?

Project A should be adopted by comparing the actual range of WACC(Weighted Average Cost of Capital).

4. Multiple IRR solutions and their correspondence

One of the pain points in current investment decision-making is that multiple IRRs are calculated. This has been known for some time, but in practice it is extremely rare and could be ignored. Recently, however, it is not uncommon for an investment project in a certain country to have negative cash in the final year (accounting year) and multiple IRRs. We will solve this problem with business calculus.

1) Why do multiple IRR solutions occur?

*The unique profit rate for each project, taking into consideration up to the third period

e.g. initial investment amount: a, period 1: b, period 2: c, period 3: d.

*at which the NPV becomes zero.

The investment up to the third period can be represented by a 3dimensional equation, given by 1 + IRR = X.

<-- 3dimensional equation for x.

<-- 3dimensional equation for x.The equation can have 1 to 3 real solutions.

* If the IRR solution is not negative

There can be 0 to 3 real solutions, including possible solutions with imaginary components. This is because the solutions may include 1, 2 or 3 real roots, or 1 real root and a pair of complex conjugate roots.

*If there are no negative cashflows in the equation

There can be 0 or 1 real solutions for IRR, depending on whether the cashflows have the same sign or not. If all cash flows are positive, there will be only one real solution for the IRR. If there are both positive and negative cash flows, there may be 0 or 1 real solutions for the IRR, depending on the magnitude and timing of the cash flows."

2) Actual profile

3) Practical countermeasures

(1)Create an NPV profile -> Reconsider your company's WACC and NPV.

(2)In general, many projects with multiple IRR solutions have low NPV -> Reject the projects

(3) Initial investment and readjustment of inflow in each period→Avoid multiple solutions

A quick note on business calculus: Calculation of pi by definite integral